FinTech Start-up Looks to Expand Operations to Grand Cayman

FinTech Start-up Looks to Expand Operations to Grand Cayman

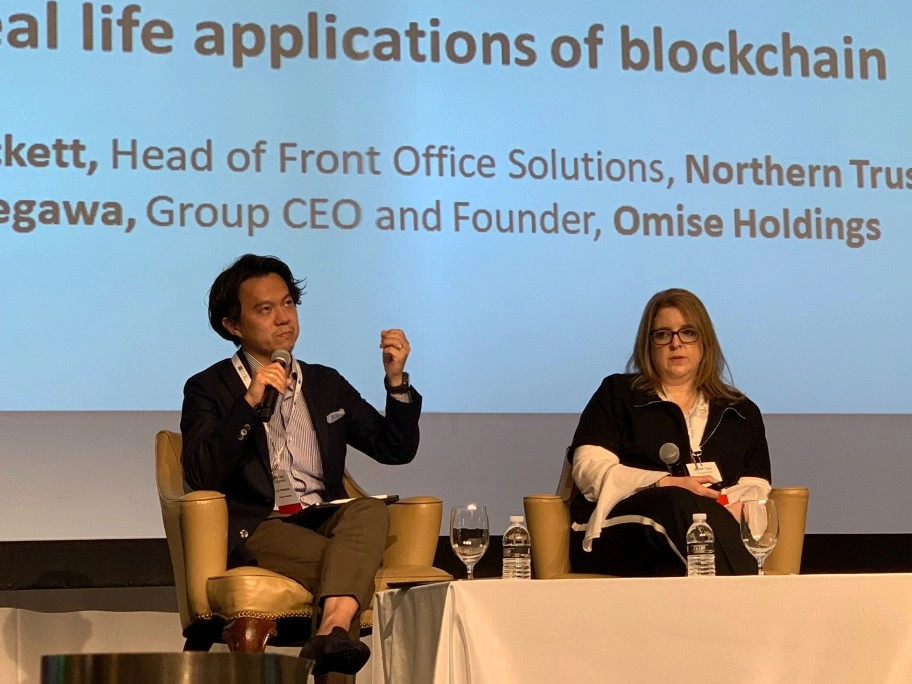

Omise Holdings’ (“Omise”) founder and CEO Jun Hasegawa recently spoke at GAIMOps Cayman on The Real-Life Applications of Blockchain alongside Northern Trust. The leading payment gateway provider in Southeast Asia, Omise was on-island to explore opportunities to expand its operations to the Cayman Islands.

Omise provides strategic advisory services to its subsidiaries (Omise Payment Gateway, OmiseGO and GO.Exchange) and raises funds on their behalf.

The company aims to transform payments by combining traditional and non-traditional financial services and platforms in an open infrastructure.

At the keynote interview, attendees learned about new financial technology advancements, including the recently launched exchange platform GO.Exchange, and how blockchain technology can support and create efficiencies for economies – from emerging markets to large institutional investors.

“We live in a mobile world with a very large population of ‘underbanked’ individuals, who do not have access to basic financial services such as savings, lending or payment methods,” explained Hasegawa. “These individuals can be serviced by centralized networks like GO.Exchange because these networks can be used without requiring a third-party. Instead of trusting influential or biased relationships, people can now trust a mathematically, non-biased protocol.”

OmiseGO, one of Omise’s subsidiaries. is also helping financial services providers (“FSPs”) solve issues caused by centralization via its development of the OMG Network. The OMG network is a decentralized public network that can bridge legacy financial systems with blockchain technology to help alleviate performance problems, remove friction and ease capital flow bottlenecks. OmiseGO is building a global platform for open financial services, which will enable transparent, peer-to-peer transactions in real-time and facilitate self-sovereign financial services across geographies, asset classes and applications. The team also works with these enterprises to form their payment and eWallet strategy, co-create new products and provides consulting services and implementation support.

These developments can help to significantly streamline processes like Know Your Customer (KYC) and directorship services. For example, instead of physically stamping the document copy, a notary can use a private key to digitally sign the document and use the intended FSP’s public key to secure and encrypt the document. The intended FSP can then use their private key to decrypt the document while also using the notary’s public key to identify and authenticate that the notary was the true originator of that action.

As the sixth largest financial center in the world, Cayman is an attractive jurisdiction for leading fintech companies such as Omise Holdings, who already recognizes that the island has the ingredients necessary to support fintech unicorns (billion-dollar companies).

“While on-island, we learned a lot about the local ecosystem, and we were blown away by the island’s caliber of service providers and robust regulatory and compliance framework. We are keen to work with the jurisdiction to set-up a fully-compliant infrastructure that meets Cayman’s globally-recognized compliance standards to support our business objectives.”

Currently, Omise (Payment Gateway) serves small, medium, and global enterprises such as McDonald’s, Burger King, Toyota, and DTAC. The firm is one of the fastest growing companies in Southeast Asia and has been recognized by Forbes Japan as one of the top 10 best start-ups for two consecutive years. To learn more, visit website www.omise.co/about.

Latest News

-

Missing: Keron ParchmanPolice/Cou...20 February 2026, 05:39 AM

-

Statement on the Premier’s Update Regarding Cannabis Decriminalisation and the National LotteryPolitics20 February 2026, 05:38 AM

-

Woman Arrested Following Collision Involving Parked VehiclesPolice/Cou...20 February 2026, 05:37 AM

-

Mayo Clinic opens patient information office in Cayman IslandsBusiness20 February 2026, 05:35 AM

-

Public Consultation Opens on Update to Immigration Application FeesGovernment...20 February 2026, 05:34 AM